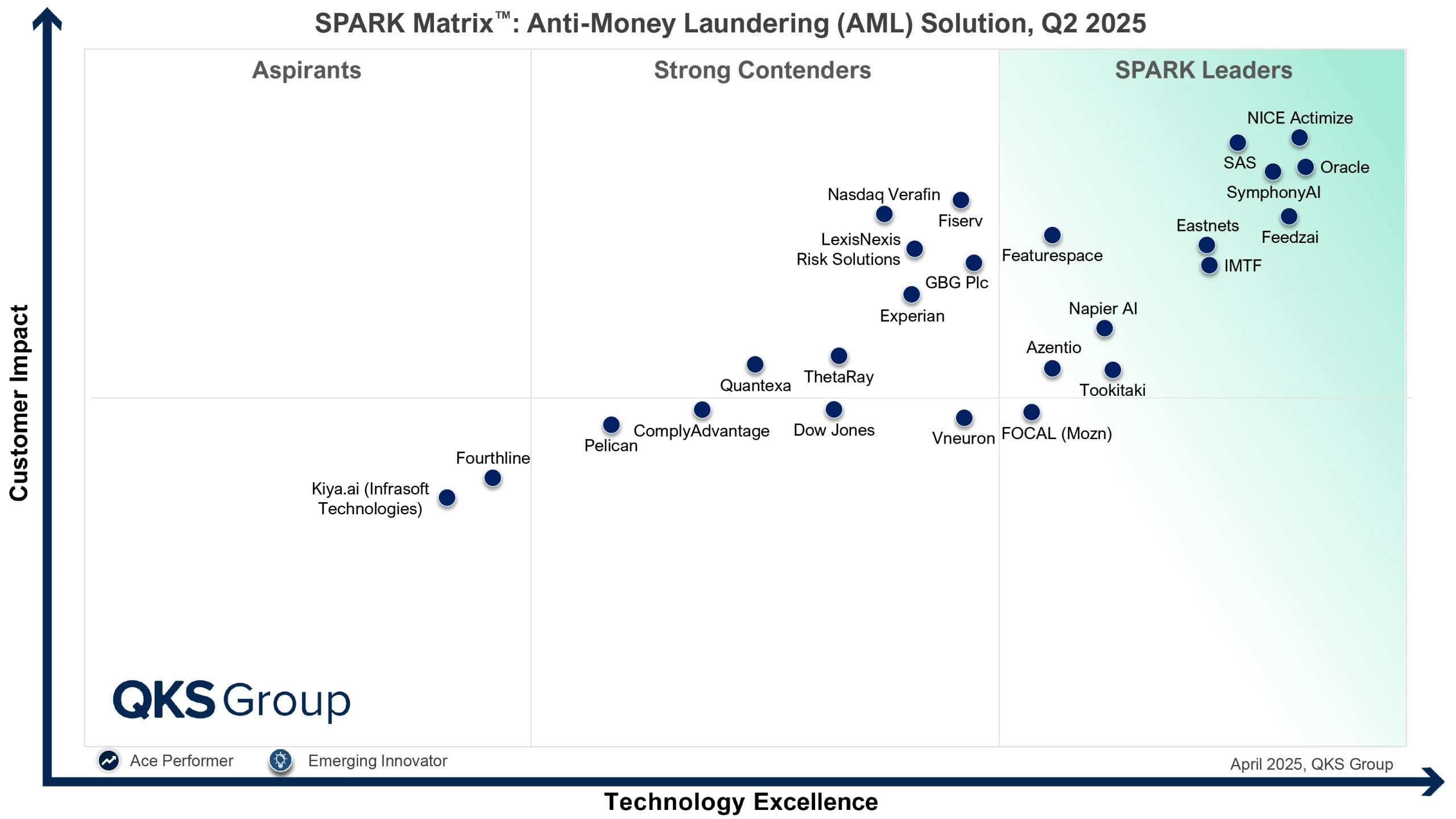

Singapore – [April 24, 2025] – Azentio Software, a leading technology enabler for banking, financial services, and insurance institutions across the Middle East, Africa, and South East Asia, has been named a Leader in the SPARK Matrix™: Anti-Money Laundering (AML) Solutions, 2025 by QKS Group, a global research and advisory firm.

This recognition reflects Azentio’s continued commitment to helping financial institutions strengthen their AML frameworks through purpose-built, future-ready compliance technology. In its assessment, QKS Group evaluated global AML solution providers across two primary dimensions – technology excellence and customer impact – with Azentio receiving high scores on both fronts.

Azentio’s flagship AML platform, AMLOCK, has been widely adopted by organisations seeking to modernize their approach to financial crime prevention. Designed with flexibility and scalability in mind, AMLOCK enables institutions to detect, investigate, and report suspicious activity while remaining fully aligned with both local and international regulatory requirements.

According to the QKS report, AMLOCK stands out for its AI-powered risk scoring, configurable workflows, and seamless integration capabilities. Its modular architecture allows institutions to adapt quickly to evolving compliance demands, while automation and intelligent alert classification help reduce operational workload and improve accuracy.

Ruchi Tripathi, Director of Product Management for AMLOCK at Azentio, commented: “We are proud to be recognized as a Leader in the SPARK Matrix™, and this acknowledgment underscores the real-world impact our AML solution is having for our clients. As financial crime grows increasingly complex, we remain focused on delivering intelligent, reliable technology that helps institutions protect their customers and their reputations.”

Siddharth Arya, Senior Analyst at QKS Group, added: “Azentio AMLOCK is a modular, AI-powered AML platform that helps financial institutions detect, investigate, and report suspicious activities. The platform combines AI-driven risk intelligence, process automation, and jurisdiction-specific reporting into a unified platform. With innovations like supervised alert classification, dynamic risk scoring, and configurable case workflows, AMLOCK empowers institutions to respond to financial crime in real time. Its deep regulatory alignment, flexible deployment and seamless integration make it one of the most dependable and scalable solutions to meet the evolving compliance requirements across diverse financial environments in the AML space.”

Azentio continues to invest in innovations that support the evolving needs of financial institutions, with a clear focus on regulatory alignment, operational efficiency, and risk mitigation. The recognition from QKS Group reinforces Azentio’s position as a trusted technology partner for AML transformation and long-term compliance success.