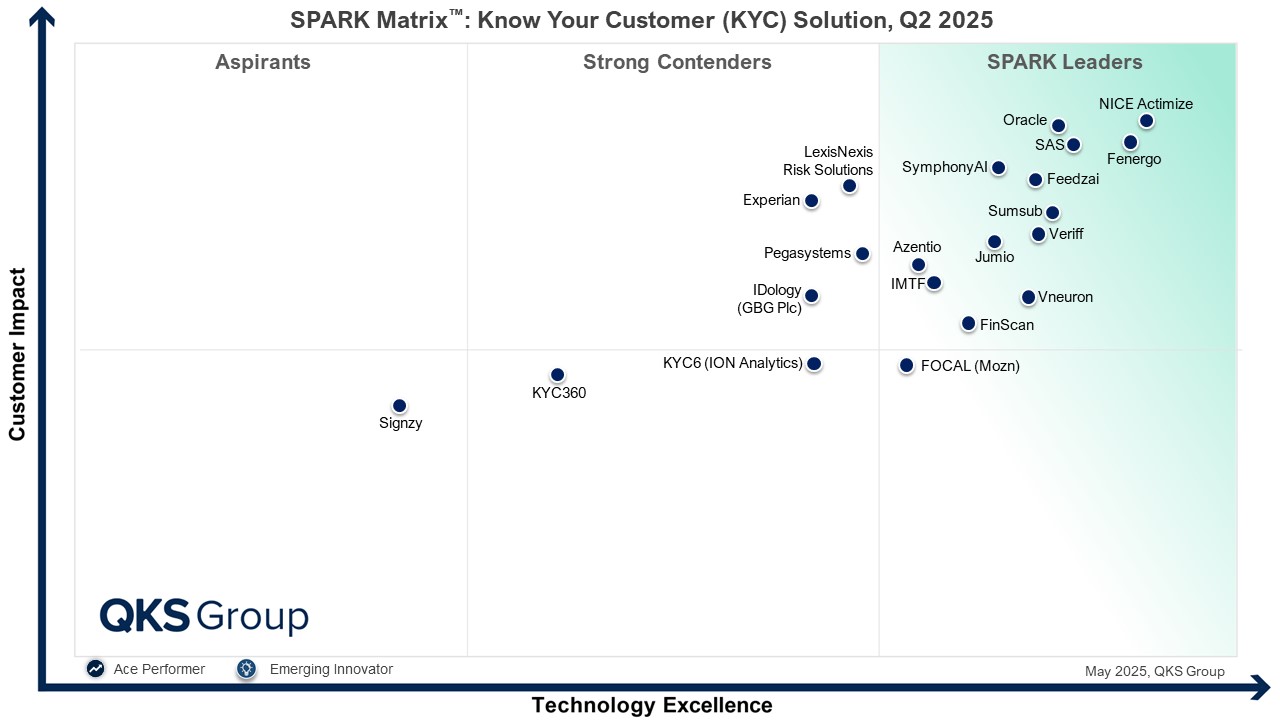

Singapore – [May 15, 2025] – Azentio Software, a leading technology enabler for banking, financial services, and insurance institutions across the Middle East, Africa, and South East Asia, has been named a Leader in the 2025 SPARK Matrix™: Know Your Customer (KYC) Solutions, by QKS Group, a global research and advisory firm.

Azentio’s KYC solution, delivered through its modular Amlock platform, integrates identity verification, enhanced due diligence, and customer lifecycle risk management into a unified compliance framework. Designed to support financial institutions across diverse regulatory environments, Azentio’s AI-enabled KYC solution supports dynamic risk scoring and peer-group intelligence to identify anomalies and high-risk entities. With features like AI-based peer profiling and clustering, event-triggered reviews, and document expiry tracking, Azentio KYC helps institutions maintain an up-to-date understanding of customer risk.

By leveraging advanced technologies for real-time screening and precise risk scoring, the solution empowers businesses to mitigate financial crime risks effectively while adhering to both global and local regulatory requirements. The result is a secure, efficient, and frictionless onboarding process that supports long-term business growth and regulatory compliance.

Ruchi Tripathi, Director of Product Management for Amlock at Azentio, commented: “We are delighted to be recognized as a leader in the 2025 SPARK Matrix™ for KYC Solutions. This recognition highlights our commitment to delivering advanced AML onboarding and KYC solutions that help financial institutions meet regulatory demands with speed and accuracy. With intelligent customer due diligence, real-time risk scoring, and AI-driven automation, the Amlock platform streamlines onboarding while strengthening financial crime risk management across the compliance lifecycle.”

Siddharth Arya, Senior Analyst at QKS Group, added: “Azentio is reshaping digital KYC compliance by combining risk-based onboarding, centralized customer profiling, and jurisdiction-specific rule enforcement into a single, adaptable platform. With innovations in real-time screening, AI-enhanced due diligence, and lifecycle-based customer monitoring, it empowers financial institutions not just to verify identities, but to manage customer risk holistically and proactively. Its robust case automation, flexible rule engine, and integration-ready architecture make it one of the most forward-focused platforms in the KYC compliance space today, equipping institutions to navigate evolving regulatory demands with confidence, precision, and speed.”

This recognition from QKS Group is a significant milestone for Azentio, reaffirming our position as a trusted partner in the compliance space. We are continuously investing in advanced technologies to help our customers navigate an increasingly complex and dynamic regulatory landscape with confidence.