Article

Serving the mass affluent with conversational AI

Abhijeet Singh Hazare, Regional Sales Director at Azentio

5 minutes

27.07.2023

Article

Abhijeet Singh Hazare, Regional Sales Director at Azentio

5 minutes

27.07.2023

Abhijeet Singh Hazare, Regional Sales Director for Middle East and Africa at Azentio Software, says that wealth managers in the Middle East can leverage conversational AI to capture a rapidly growing mass affluent segment.

This article is published in The Advisor section, a part of Middle East WealthTech Landscape Report (Middle East WTLR 2023), brought out by The Wealth Mosaic, a leading information and knowledge resource for the global wealth management industry. The Adviser features a collection of articles and interviews focused on advising wealth managers on the technological tools and processes do they need to best do their jobs for the benefit of themselves, the client and the business.

Middle East WTLR 2023 provides a comprehensive guide to the technology and related vendor marketplace for the region’s wealth management community.

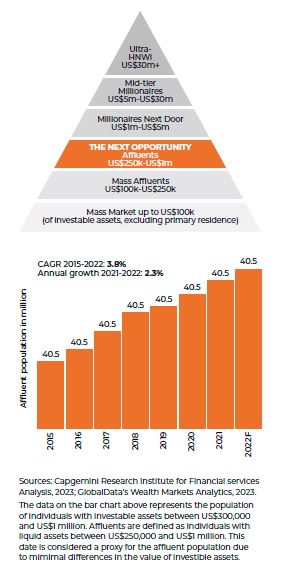

The Middle East is experiencing a rapid increase in the mass affluent population – individuals with substantial assets and investable wealth and likely to become High-Net-Worth Individuals (HNWIs) in the future.

With this in mind, Middle East wealth managers are witnessing a significant shift in their strategic focus. While catering to Ultra-High-Net-Worth Individuals (UHNWIs) has traditionally been the primary goal, there is now a growing recognition of the immense potential presented by the mass affluent segment.

“Conversational AI offers the potential to unlock new opportunities, enhance customer experiences, and cultivate long-term relationships with a mass affluent customer base.”

According to the World Wealth Report 2023 by Capgemini, affluent individuals, with investable assets between US$250,000-1 million, possess a staggering US$27 trillion in wealth. They form a significant population base and have the potential to become future HNWIs if engaged early in their financial journey within the wealth management ecosystem.

It includes many expatriates working across the Gulf Cooperation Council (GCC) who also boast personal savings of anywhere between US$50,000 to US$2 million, according to Global Finance. Indeed the Middle East is attracting an unprecedented influx of affluent migrants. The United Arab Emirates (UAE), in particular, attracted more than 5,000 newcomers, the largest net inflow of millionaires globally in 2022. They constitute between 5% to 10% of assets under management (AUM) for wealth managers today, it says.

As this market continues to grow, wealth managers are, accordingly, shifting their attention to this previously underserved segment. Indeed, in 2022 Capgemini found that only 27% of wealth management firms currently serve mass affluent customers, and only 36% firms are exploring mass affluent services.

Moreover, past attempts to target the mass affluent market have not done well because the cost of applying a private banking model of high touch and personalised service to this service have not been cost effective.

But what is emerging is that unlike HNWIs and UHNWIs, who require highly personalised and bespoke services, mass affluent customers seek a balance between digital convenience and human interaction.

And according to Capgemini, this segment likes to shop around and spread assets across several providers, so providers will have to work hard to attract them in the first place and then retain them with a model that works for them.

The advent of technology brings transformative possibilities. By implementing a service model that combines seamless digital interactions with timely access to advisers, wealth managers have the potential to attract and retain mass affluent customers during their wealth-building journey. This approach paves the way for these customers to transition into traditional private banking customers in the future, with significant impact.

This shift in focus creates an opportunity for wealth managers to deploy technology.

How can technology help?

The expansion of WealthTech and FinTech, hybrid robo-services, and the rising customer expectations for digital and personalised services, means that wealth managers now have the means to reach this group. Indeed, wealth managers will need to leverage the latest in technology innovation to differentiate and compete. Today’s world means that investments need to be made in digital channels. Artificial Intelligence (AI), and Machine Learning (ML) are required to better know the customer and serve them.

Indeed, a recent McKinsey study predicted that, by 2030, up to 80% of new wealth management customers (the Generation X’s and Millennials) will require data-driven, hyper-personalised advice that can be delivered seamlessly, continuously, and effectively, having grown accustomed to on-demand streaming (Netflix) and one-click purchasing (Amazon).

And UBS Wealth Management’s CIO recently said that AI is set to accelerate into a US$90 billion industry by 2025 as ChatGPT sparks an investment frenzy.

Meeting these customer expectations requires more than automation. Wealth managers who can leverage data and analytics in delivering services, cutting investment research costs and customer reporting and acquisition time, will continue to thrive. Understanding how to leverage AI and tools like ChatGPT is existential.

Something that will be particularly useful to effectively tap into this market is conversational AI – commonly used in chatbots and virtual assistants. This potent mix of Natural Language Processing (NLP) and ML takes large volumes of data to help imitate human interactions. It recognises speech and text inputs and translates them into something meaningful.

Banks are already using it in the form of chatbots; prominent users include DBS Private Bank and Royal Bank of Canada. The latter’s NOMI digital banking platform offers insights, savings, budgeting and a text and voice-based chatbot. Standard Chartered, meanwhile, has a chatbot that delivers human-like conversations.

In this way, conversational AI offers the potential to unlock new opportunities, enhance customer experiences, and cultivate long-term relationships with a mass affluent customer base.

Transforming customer conversations

Conversational AI revolutionises customer conversations by providing sophisticated virtual assistants that can understand natural language, respond intelligently, and provide personalised insights. These AI-powered assistants act as reliable and accessible resources, offering customers real-time information, market updates, investment recommendations, and answers to their queries. Through seamless integration with various communication channels, including web-based chatbots, messaging apps, and voice assistants, wealth managers can deliver an exceptional customer experience, effortlessly blending automation with human touchpoints.

Empowering self-service capabilities

Conversational AI empowers mass affluent customers with self-service capabilities, allowing them to access information, perform transactions, and obtain advice conveniently. AI-powered chatbots and virtual assistants act as trusted advisers, providing timely responses and empowering customers to make informed decisions. By leveraging conversational AI, wealth managers can extend their service offerings beyond traditional office hours, ensuring 24/7 availability and personalised assistance to their customers whenever they need it. This accessibility fosters trust, strengthens relationships, and positions wealth managers as reliable partners in their customers’ financial journeys.

Tailoring investment recommendations

Understanding the unique financial goals, risk appetite, and preferences of mass affluent customers is critical for wealth managers. Conversational AI, equipped with advanced algorithms and ML capabilities, can analyse vast amounts of data to generate tailored investment recommendations. By processing historical data, market trends, and customer-specific information, conversational AI can provide personalised investment strategies that align with individual customer objectives. This level of customisation enhances the value proposition for mass affluent customers, driving customer satisfaction and loyalty.

Driving operational efficiency

Conversational AI offers wealth managers an opportunity to streamline their operations, reduce costs, and maximise efficiency. AI powered virtual assistants can handle routine administrative tasks, freeing up relationship managers to focus on more value-added activities such as customer engagement and portfolio management. By automating processes like customer onboarding, account opening, and data gathering, wealth managers can enhance operational efficiency, optimise resource allocation, and scale their businesses effectively.

We are happy to hear from you and answer your questions. Let's begin our journey together.